From Little Things - ESIC Tax OffsetAs the world changes, technology changes with it. Whether it's COVID forcing us to embrace remote working, the

Latest Insights about Corporate Tax

New legislation to enable corporate entities to utilise losses across prior year tax liabilities have received royal assent on the 14 October 2020 and has taken effect.

If you fail to plan, you are Planning to fail'

Another year, another June 30. A big day for business owners and accountants. To keep your end of

We live in a fast-changing world! Superannuation Income Streams....

The Federal Government has announced an extension of the temporary reduction in mi

On 1 March 2021, the ATO released its Draft Practical Compliance Guideline PCG 2021/D2, which sets out its intended compliance approach to the allo

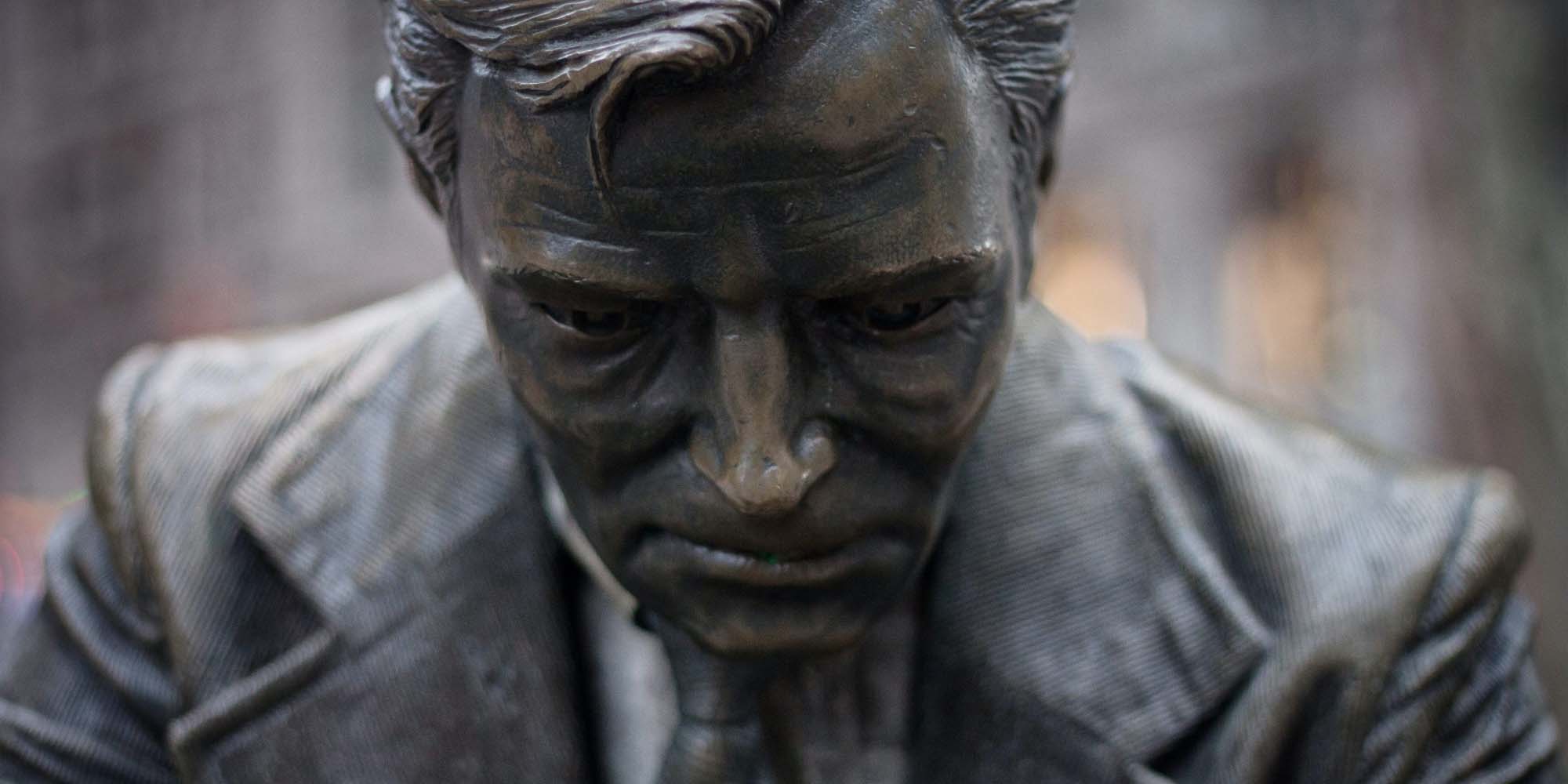

Josh's Booster Rocket

There are winners and losers every year in every budget address, and the 2021/22 budget is no exception. This year's announc

We are busy scouring through 100's of pages preparing our report. We will update this page as soon as it is ready.

Please see our review of the budg

Proudly Presents:

Business Masterclass Series

Are you getting what you are entitled to?

Refundable Grants Special Topic

25 March 2021

Hall Chadwick Bo

Recently Treasury Laws Amendment (2020 Measures No 6) Bill 2020 was tabled in parliament and it provides a critical update to Federal Treasurer Josh F

Due to COVID-19 changing the way we live, working from home is suddenly the new normal.Many Taxpayers have set-up an office space in their homes and w