With the federal election now reaching a decisive conclusion, a range of tax changes that previously seemed far away are now much closer to reality.

Taxpayers and business owners are encouraged to seek personalized advice to understand how these measures may impact their specific circumstances and how to best position themselves.

Here are some of the tax changes promised by the Federal Government over its next term.

$1,000 Instant Tax Deduction

The government has promised an instant $1,000 tax deduction for every working taxpayer. Like the American automatic tax deduction, it will allow taxpayers to claim $1,000 for work expenses without substantiation. To claim the tax deduction, taxpayers will have to earn income from labour activities. This means people earning business or investment income will continue to deduct their expenses in the usual way.

Instant Asset Write Off for Small Businesses

The instant asset write-off allows small businesses to claim an immediate deduction for the business-use portion of the cost of an asset in the year it is either first used or first installed ready for use. The threshold applies on an asset-by-asset basis and can be used for new and second-hand assets. The default threshold is $1,000, but past governments have temporarily increased it several times, floating between $20,000 and $150,000 since 2016. It has also been supported by the temporary full expensing regime that ended on 30 June 2023.

The current $20,000 threshold is set to expire on 30 June 2024. Prime Minister Anthony Albanese has announced an extension to the current instant asset write off threshold of $20,000 for an additional 12 months to 30 June 2025.

Cost of Living Tax Cuts

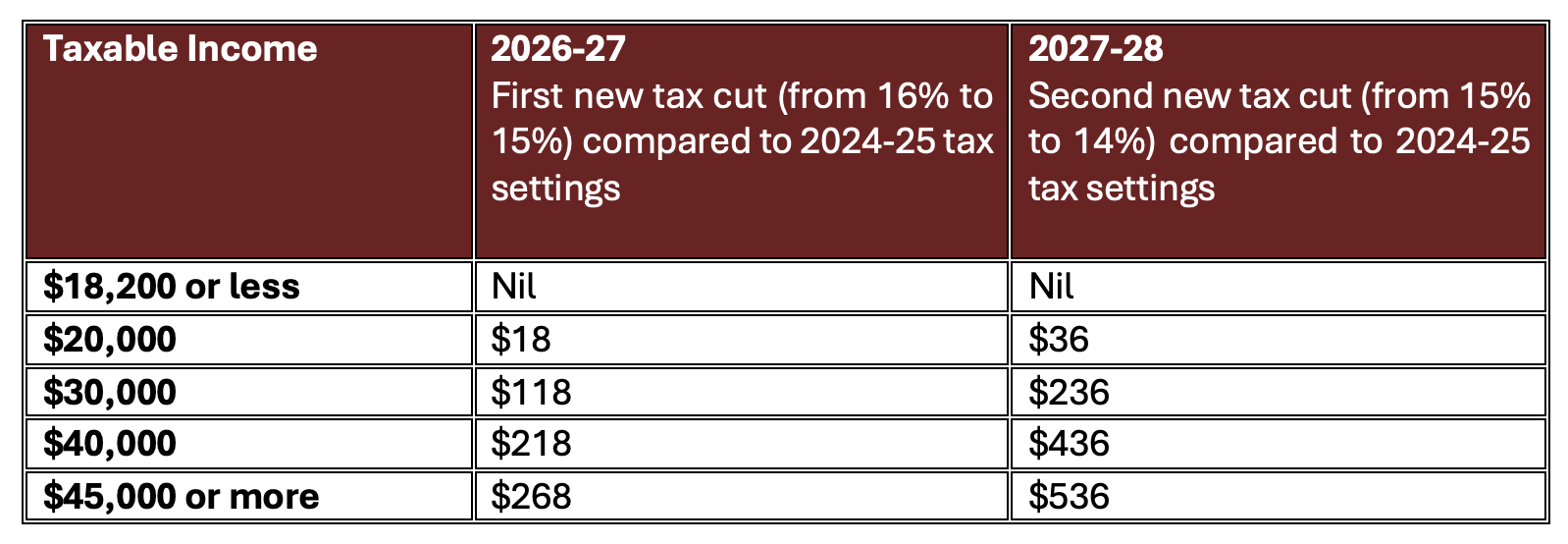

The government has announced a reduction in the tax rate on taxable income between $18,200 and $45,000. The rate will reduce from the current rate of 16% to a rate of 15% for the year ended 30 June 2027. A further reduction to 14% will apply from 1 July 2027 onwards.

Benefits from the tax cuts are summarised in the table below:

The return of Division 296

Although it did not pass before the election, superannuation is back in the crosshairs with increased likelihood of implementing the proposed Division 296 tax. Proposed to take effect from 1 July 2025, the new Division adds a 15% tax on earnings related to superannuation balances exceeding $3 million. Labor included the projected revenue from the proposed ‘$3 million super tax’ in the recent Federal Budget – showing they are committed to implementing the bill.

For individuals with large self-managed superannuation funds or large super balances, it is important to seek professional financial advice on how to prepare for these potential changes.

Student Debt Clearance

The government has also promised to cut student debt by 20% in a one-off debt reduction. Additionally, an increase to the student debt repayment threshold will be increased, such that workers with a HECS debt will only need to begin repaying if they earn $67,000 annually from 1 July 2025 onwards (up from the current threshold of $54,435).

Anyone with the following loans will benefit:

- HELP loans, including: HECS-HELP, FEE-HELP, STARTUP-HELP, SA-HELP, OS-HELP

- VET Student loans

- Australian Apprenticeship Support Loans

- Student Start-up Loans

- Student Financial Supplement Scheme

With Labor securing a fresh mandate, a range of tax reforms are now on the horizon. These reforms focus on reducing compliance and increasing financial support. Taxpayers and business owners are encouraged to seek personalised advice to understand how the reforms may impact their circumstances, and how best to prepare.

To find out how these upcoming tax changes could affect you or your business, get in touch with the Hall Chadwick WA team for tailored advice and support.